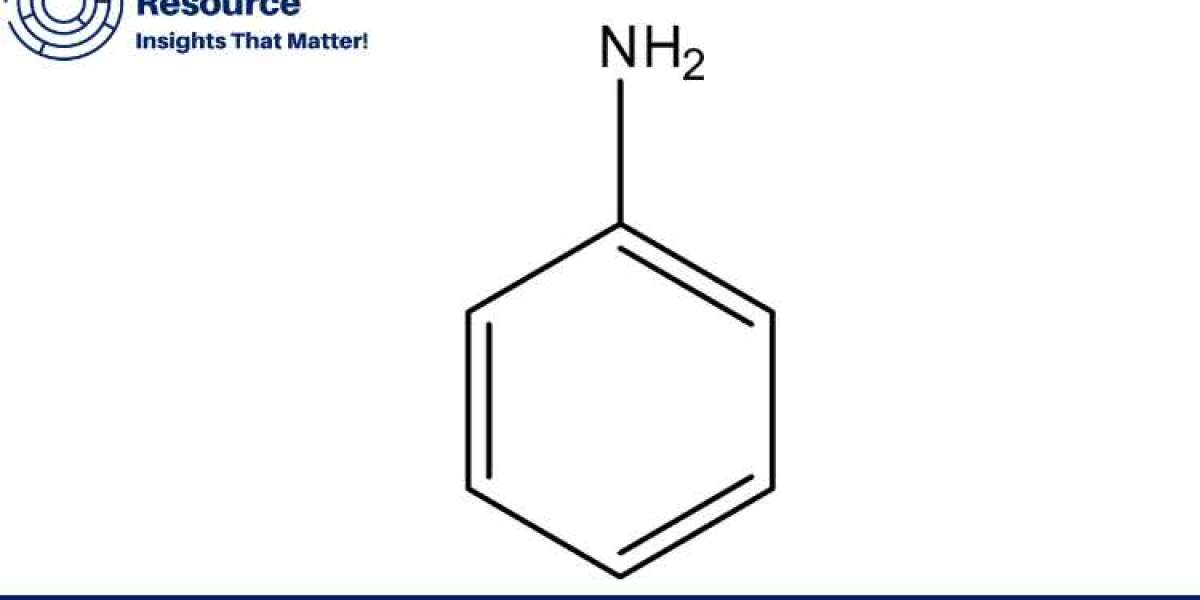

Aminobenzene, commonly known as aniline, is a crucial chemical used in a variety of industries, including dyes, pharmaceuticals, rubber processing, and the production of polyurethane foam. As a key intermediate in numerous industrial processes, understanding the Aminobenzene Price Trend is essential for manufacturers, suppliers, and stakeholders to make informed decisions regarding procurement and production strategies. This press release provides an in-depth analysis of the aminobenzene price trend, charts, news, and the overall market outlook, helping businesses navigate this complex landscape.

Aminobenzene Price Trend

The Aminobenzene Price Trend has experienced significant fluctuations in recent years due to a combination of factors, including raw material availability, energy prices, supply chain disruptions, and global demand. Aminobenzene is primarily derived from benzene, a petrochemical product whose price is influenced by crude oil markets, making aminobenzene prices highly sensitive to global oil price fluctuations.

Request Free Sample – https://www.procurementresource.com/resource-center/aminobenzene-price-trends/pricerequest

In 2020, the COVID-19 pandemic significantly disrupted global supply chains, causing a sharp decline in industrial activity and demand for chemicals, including aminobenzene. As a result, the Aminobenzene Price Trend saw a temporary dip, with prices falling to lower-than-usual levels. However, as global economies began to recover in late 2020 and early 2021, demand for aminobenzene surged, driven by increased production in industries like pharmaceuticals, rubber, and dyes, which rely heavily on aniline as a feedstock.

By mid-2021, the aminobenzene price trend experienced a steep upward trajectory as rising crude oil prices pushed up the cost of benzene, the primary raw material. The increase in oil prices, coupled with ongoing supply chain challenges and labor shortages, contributed to sustained price growth for aminobenzene throughout 2021 and into 2022.

In 2022, the Aminobenzene Price Trend was further influenced by geopolitical tensions, particularly the Russia-Ukraine conflict, which led to increased volatility in energy markets and disrupted the supply of key raw materials. This contributed to higher production costs for aminobenzene, driving prices even higher. Despite these challenges, demand for aminobenzene remained strong, particularly from industries such as rubber processing, where aniline is used in the manufacture of chemicals for tires and other rubber products.

Looking forward, the Aminobenzene Price Trend is expected to remain volatile in the short term due to ongoing geopolitical uncertainties, energy market fluctuations, and supply chain constraints. However, as global markets stabilize and energy costs normalize, aminobenzene prices may begin to level off, providing more predictable pricing for manufacturers and suppliers.

Aminobenzene Price Analysis

A detailed Aminobenzene Price Analysis reveals several factors influencing the market. One of the primary drivers behind price fluctuations is the cost of benzene, a petrochemical feedstock derived from crude oil. As benzene prices are closely tied to crude oil markets, any fluctuations in global oil prices have a direct impact on the price of aminobenzene.

In 2021 and 2022, rising oil prices drove up the cost of benzene, leading to higher production costs for aminobenzene. This was exacerbated by supply chain disruptions, including transportation bottlenecks, labor shortages, and increased shipping costs. The combination of rising raw material costs and supply chain challenges contributed to the sustained price increases seen in the aminobenzene market.

Demand for aminobenzene is another critical factor shaping price trends. The chemical is used in various industries, including the production of dyes, pharmaceuticals, and rubber products. As these industries recover from the impacts of the pandemic, demand for aminobenzene has increased, putting additional upward pressure on prices. The growing use of aminobenzene in the production of polyurethane foams, which are widely used in the construction and automotive sectors, has also contributed to strong demand.

Environmental regulations and sustainability initiatives are influencing the Aminobenzene Price Trend as well. Governments around the world are implementing stricter regulations on the production and use of petrochemical products, including benzene and its derivatives, to reduce their environmental impact. These regulations often lead to increased production costs for aminobenzene manufacturers, further driving up prices.

In summary, the Aminobenzene Price Analysis highlights the key drivers of price fluctuations, including rising raw material costs, supply chain disruptions, increasing demand from key industries, and environmental regulations.

Aminobenzene Price Chart

A Aminobenzene Price Chart is a valuable tool for visualizing price movements over time, providing businesses with insights into historical trends and potential future price developments. Recent price charts for aminobenzene indicate significant price increases from mid-2020 onwards, as the market recovered from the initial impact of the COVID-19 pandemic.

The price chart shows a dip in early 2020, reflecting reduced industrial activity and lower demand for chemicals. However, by the end of 2020, prices began to rise steadily as global manufacturing resumed and demand for aminobenzene surged, particularly in the pharmaceutical and rubber processing sectors.

In 2021, the Aminobenzene Price Chart shows a steep upward trend, driven by rising crude oil prices, supply chain disruptions, and increased demand from industries such as automotive, construction, and textiles. The chart highlights significant price spikes during periods of heightened geopolitical tensions and oil market volatility, particularly in 2022 when the Russia-Ukraine conflict disrupted energy supplies and led to sharp increases in production costs for chemicals like aminobenzene.

For businesses, analyzing the price chart allows them to identify patterns and anticipate price movements, helping them make informed decisions about procurement and inventory management.

Aminobenzene Price News

Recent Aminobenzene Price News has been dominated by discussions around rising raw material costs, geopolitical tensions, and supply chain challenges. One of the most significant factors influencing aminobenzene prices in recent months has been the volatility in global oil markets. As crude oil prices have risen, the cost of benzene, the primary raw material for aminobenzene, has increased, leading to higher production costs for the chemical.

The ongoing Russia-Ukraine conflict has further exacerbated these challenges, disrupting energy supplies and creating uncertainty in the market. This has contributed to price volatility across the chemical industry, including for aminobenzene, as manufacturers face higher energy costs and supply chain disruptions.

Another key development in the Aminobenzene Price News is the growing demand for aminobenzene in emerging markets, particularly in Asia-Pacific. As economies in the region continue to industrialize, demand for chemicals used in manufacturing, such as aminobenzene, has increased. This rising demand, combined with supply chain constraints, has contributed to higher prices for aminobenzene in these markets.

Additionally, environmental regulations and sustainability initiatives are shaping the future of the aminobenzene market. As governments around the world impose stricter regulations on the production and use of chemicals derived from petrochemicals, manufacturers are being forced to invest in cleaner, more sustainable production processes. While these initiatives are essential for reducing the environmental impact of chemical production, they also increase production costs, contributing to higher prices for aminobenzene.

Aminobenzene Price Index

The Aminobenzene Price Index is a key indicator of overall price movements in the global aminobenzene market. The index aggregates data from various sources, providing a comprehensive view of price trends across different regions and industries. In recent years, the aminobenzene price index has shown a steady upward trend, reflecting rising raw material costs, supply chain disruptions, and increasing demand from key industries.

In 2020, the price index remained relatively stable, with a slight decline in the early part of the year due to reduced industrial activity during the pandemic. However, by mid-2020, the index began to rise as global manufacturing resumed and demand for chemicals like aminobenzene increased.

The Aminobenzene Price Index continued to climb throughout 2021 and 2022, driven by rising crude oil prices, supply chain challenges, and strong demand from industries such as rubber processing, pharmaceuticals, and construction. The index also reflects regional variations in pricing, with prices in North America and Europe being particularly high due to energy market disruptions and logistical challenges.

Aminobenzene Price Graph

The Aminobenzene Price Graph provides a dynamic visualization of price trends over time, helping stakeholders understand key patterns and shifts in the market. The price graph for aminobenzene shows a clear upward trend from mid-2020 to 2023, with significant price increases during periods of supply chain disruptions and rising energy costs.

In early 2020, the Aminobenzene Price Graph shows stable prices, followed by a decline as industrial activity slowed due to the COVID-19 pandemic. However, by mid-2021, prices began to rise sharply as global demand for aminobenzene surged, driven by increased production in key industries such as pharmaceuticals and rubber.

The price graph for 2022 and 2023 highlights the impact of geopolitical tensions, particularly the Russia-Ukraine conflict, on energy markets and chemical production costs. As energy prices rose, the cost of producing aminobenzene increased, leading to sharp price spikes during this period.

For businesses, analyzing the Aminobenzene Price Graph is essential for understanding market dynamics and anticipating future price movements, allowing them to make informed decisions about procurement and production strategies.

About Us:

Procurement Resource is an invaluable partner for businesses seeking comprehensive market research and strategic insights across a spectrum of industries. With a repository of over 500 chemicals, commodities, and utilities, updated regularly, they offer a cost-effective solution for diverse procurement needs. Their team of seasoned analysts conducts thorough research, delivering clients with up-to-date market reports, cost models, price analysis, and category insights.

By tracking prices and production costs across various goods and commodities, Procurement Resource ensures clients receive the latest and most reliable data. Collaborating with procurement teams across industries, they provide real-time facts and pioneering practices to streamline procurement processes and enable informed decision-making. Procurement Resource empowers clients to navigate complex supply chains, understand industry trends, and develop strategies for sustainable growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Amanda Williams

Email: [email protected]

Toll-Free Number: USA Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA