Benefits of Credit Loans

Credit loans provide quite a few advantages that can benefit individuals in numerous methods.

Benefits of Credit Loans

Credit loans provide quite a few advantages that can benefit individuals in numerous methods. First, they provide quick access to funds, which could be crucial in emergencies or when seizing financial opportunities. Furthermore, responsible use of credit score

Emergency Fund Loan loans can contribute to constructing a strong credit historical past, important for future borrow

What is a Pawnshop

Loan for Unemployed?

Pawnshop loans are a kind of secured mortgage the place people can borrow money by using personal property as collateral. The gadgets secured can range from jewellery and electronics to musical devices and collectibles. When you pledge an merchandise of worth, the pawnshop assesses its worth and offers you a mortgage based on a percentage of that worth. This means that you could acquire cash rapidly and with much less documentation than is typically required by banks or credit score uni

Once you have your paperwork so as, you probably can provoke the appliance process, both online or in individual. During this part, be prepared for a credit score verify, which is in a position to influence your credit rating quickly. After submitting your software, lenders will evaluation your data, and if accredited, you will obtain mortgage particulars that define the interest rate, reimbursement schedule, and any fees invol

Once your software is submitted, lenders will assess your profile primarily based on several standards, including your revenue stability, creditworthiness, and current debt levels. It’s not unusual for borrowers to experience a waiting period throughout which the lender reviews the applying, which may differ in duration. Being ready with all necessary documents might help expedite the lending proc

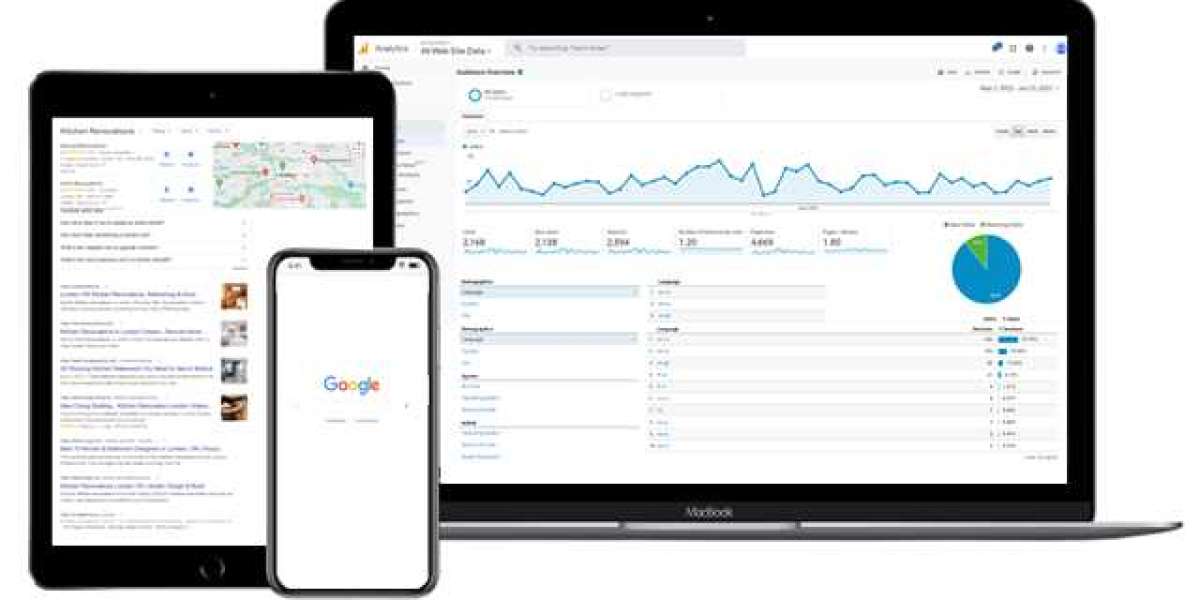

Navigating personal finance can typically feel overwhelming, however with the proper instruments and information, individuals could make knowledgeable selections that suit their needs. Daily Loan serves as a complete useful resource for anybody looking to explore their borrowing choices. From understanding several types of loans to getting recommendations on managing compensation, Daily Loan supplies valuable insights that may empower customers to take charge of their financial journeys. This article delves into the necessary thing elements of Daily Loan, its features, and the means it helps users in making well-informed decisions concerning borrow

Alternatives to Daily Loans

While Daily Loans can present swift options to monetary problems, exploring various borrowing options is worth considering. Alternatives corresponding to personal loans, credit union loans, and even borrowing from family or pals might supply more favorable terms compared to the upper rates of interest associated with Daily Loans. Researching these options can result in more sustainable financial outco

Borrowers must also contemplate making more than the minimum required payments whenever possible. This apply can help Emergency Fund Loan cut back the total curiosity paid over the lifetime of the mortgage and allows debtors to pay off the mortgage soo

Moreover, credit score loans can be used strategically to consolidate higher-interest money owed right into a single cost, probably lowering overall monetary prices. This can simplify your financial management and assist you to repay money owed extra efficiently. The versatility of credit loans allows borrowers to align their funds with private objectives effectiv

Moreover, accessing extra funds can present peace of thoughts during challenging financial conditions. For occasion, surprising medical emergencies or job loss can strain one’s finances. An additional mortgage can serve as a security web, allowing people to navigate these powerful instances more effectively. Thus, the potential for monetary stability frequently outweighs the drawbacks of taking up extra d

Additionally, should you anticipate difficulties in making payments, communicate along with your lender immediately. Many lenders are willing to work with debtors to create flexible fee plans. Proactively managing your loan not only alleviates stress but additionally builds a strong financial basis for the longer t

BePick: A Resource for Unsecured Loans BePick is a devoted platform that gives detailed info and critiques on unsecured loans. The web site serves as a useful resource for borrowers looking for to grasp their options, examine lenders, and make knowledgeable financial decisi

User Reviews and Testimonials

User suggestions is an essential component of the Daily Loan experience. The platform showcases trustworthy critiques from past customers, highlighting each optimistic experiences and areas needing improvement. This transparency aids new borrowers in gauging the reliability of lenders and the general customer service they can anticip

Choosing the Right Lender

When contemplating a no-visit mortgage, it’s essential to pick the best lender. Not all lenders operate under the identical phrases, and debtors should fastidiously consider their options. Key factors to assess embody rates of interest, repayment terms, and charges related to the loan. Online evaluations and comparisons can guide borrowers in making educated choi

Canadian pharmaceuticals online shipping

By Kelly Miller

Canadian pharmaceuticals online shipping

By Kelly MillerNghệ Thuật Tưới Nước Cho Mai Vàng: Bí Quyết Dưỡng Cây Để Tạo Nên Vườn Mai Bền Vững

By hennesy Желаете купить по отличной цене аттестат, либо диплом?

By sonnick84

Желаете купить по отличной цене аттестат, либо диплом?

By sonnick84 The Thrill of the Aviator Game: A Sky-High Adventure

By anammdd

The Thrill of the Aviator Game: A Sky-High Adventure

By anammdd Exploring the Vibrant Nightlife of Hong Kong

Exploring the Vibrant Nightlife of Hong Kong