In the ever-evolving world of cryptocurrency, savastan stands out as a platform simplifying Bitcoin automatic payments. But what does this mean for users and businesses navigating the digital finance landscape?

Bitcoin has changed the way we handle money, providing a secure and decentralized method for transactions. Automatic payments allow users to set up regular transactions without the need for manual input each time. This is particularly advantageous for businesses that thrive on recurring revenue, such as subscription services or membership platforms.

Savastan is at the forefront of this shift, offering tools that make it easy for users to automate their payments. Imagine a scenario where you never miss a payment for your favorite online service again. By leveraging automatic payment features, individuals can enjoy a seamless experience while managing their finances.

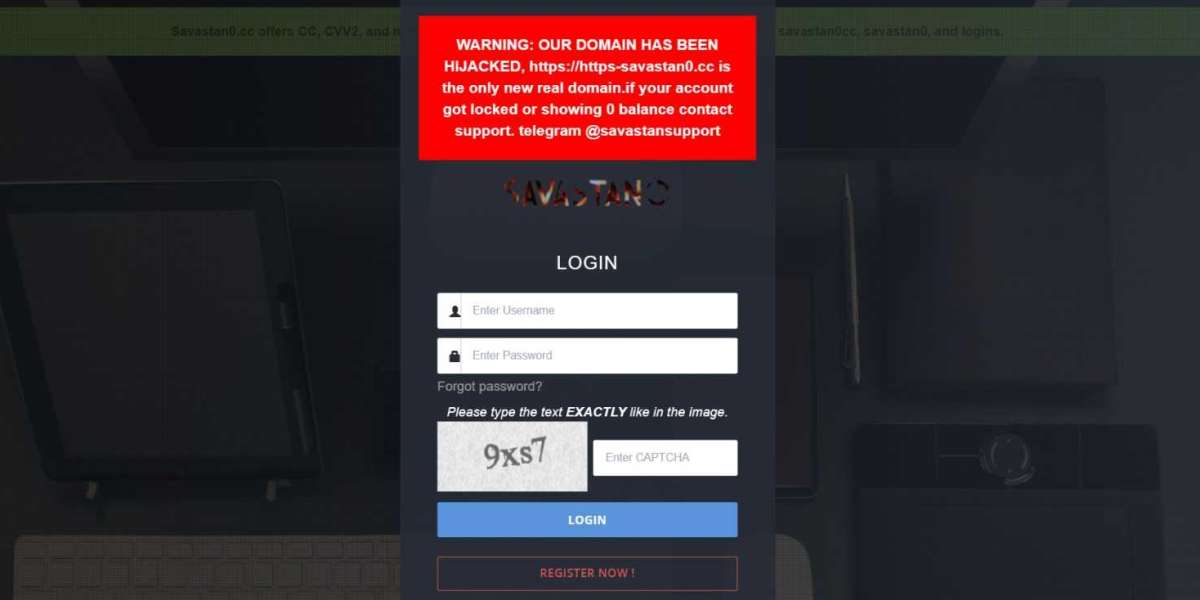

However, while the convenience is appealing, there are critical aspects to consider, especially regarding security. When using platforms that facilitate automatic payments, it’s essential to protect sensitive information like CVV codes. Fraudulent activities are a concern in the digital payment space, making it crucial for users to prioritize security and use reputable services.

As digital currencies gain traction, the demand for efficient payment solutions increases. Savastan meets this need by offering a user-friendly experience for Bitcoin transactions. This raises an important question: Are we ready to embrace the full potential of automatic payments in our daily lives, or do fears about security and data protection hold us back?

In conclusion, savastan is making significant strides in transforming how we manage our Bitcoin transactions. By understanding the advantages and challenges of automatic payments, we can better navigate the future of digital finance. Embracing these innovations may lead to a more efficient and secure way to handle our financial obligations.