Eligibility Criteria for Freelancer Loans

Eligibility for freelancer loans often hinges on a quantity of components, which might differ between lenders.

Eligibility Criteria for Freelancer Loans

Eligibility for freelancer loans often hinges on a quantity of components, which might differ between lenders. Generally, financial institutions assess the applicant's creditworthiness, income historical past, and the nature of their freelance work. Having a solid credit rating can significantly enhance the probabilities of securing a loan, as it reflects the person's ability to handle debt responsi

Additionally, some emergency loans have brief repayment terms, which can stress debtors to pay back their debt rapidly. Falling behind on repayments can hurt

Loan for Low Credit your credit rating, resulting in long-term monetary repercussions. Therefore, it is vital to evaluate whether or not you'll have the ability to realistically repay the

Car Loan within the stipulated timefr

Peer-to-peer lending platforms connect borrowers directly with particular person traders prepared to fund loans, usually at aggressive rates. Crowdfunding permits companies to present their concepts to the public, enabling them to boost small quantities of money from numerous individuals. This may be particularly effective for startups seeking to check new products or id

Delinquent loans pose important challenges for both borrowers and lenders. They occur when a borrower fails to make scheduled funds, and the account becomes overdue. This article delves into the nuances of delinquent loans, examining their causes, effects, and preventive measures. Furthermore, we'll introduce BePick, an important platform for navigating the complexities of delinquent mortgage information, assets, and evaluations. Whether you are a borrower or a lender, understanding the dynamics of delinquent loans is essential for effective monetary administrat

Another misconception is that freelancer loans include high-interest rates. While there are actually lenders that impose steep rates, many choices abound that feature competitive rates geared toward supporting freelancers’ financial growth. Thus, thorough comparability shopping is crucial in figuring out the absolute best monetary resolut

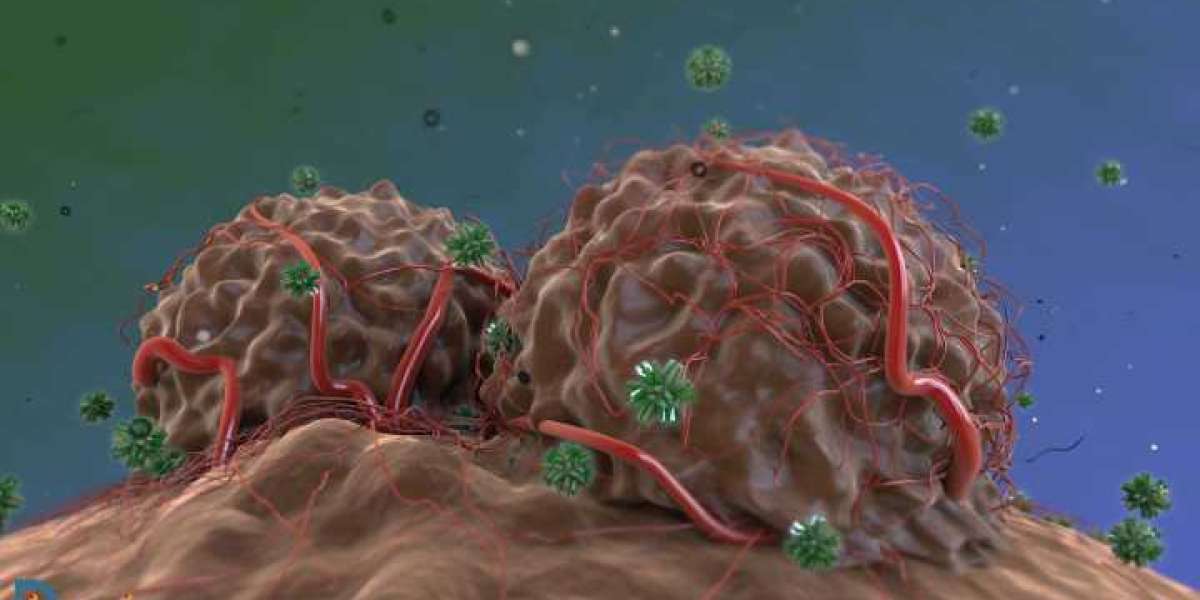

Credit-deficient loans refer to borrowing solutions tailored for individuals who don't meet the usual credit score necessities set by conventional lenders. These loans cater primarily to those with low credit score scores or those lacking an adequate credit score historical past, making traditional banks hesitant to approve their functions. The objective of these loans is to supply monetary help to those who may otherwise be excluded from mainstream financing opti

To enhance your possibilities of approval, think about demonstrating a consistent income, providing proof of regular employment, and maintaining an total manageable debt-to-income ratio. Additionally, researching lenders who particularly cater to credit-deficient debtors can also enhance your possibilit

Emergency loans can typically be used for numerous urgent wants, together with medical bills, automotive repairs, or sudden household bills. The versatility of emergency loans allows borrowers to address critical financial conditions that come up unexpecte

Freelancer loans are more and more turning into a priceless monetary useful resource for impartial workers in at present's gig economy. As many freelancers face distinctive challenges, securing funding can pose difficulties. Understanding how these loans work and the place to search out the most effective choices is essential for freelancers seeking to streamline their funds and grow their companies. This article will delve into the concept of freelancer loans, their benefits, and the way they differ from conventional lending choices. Additionally, we are going to introduce BePick, a dedicated platform offering comprehensive insights and evaluations on freelancer loans that may aid in making knowledgeable borrowing selecti

For those with deficient credit, understanding how scores are calculated is vital. Factors influencing credit score scores embody fee history, credit score utilization, size of credit history, kinds of credit score used, and up to date credit inquiries. By taking steps to improve your credit score score, people can enhance their probabilities of securing higher mortgage terms sooner or la

Individuals navigating the world of credit-deficient loans ought to benefit from the numerous assets available. Websites like 베픽 provide detailed information about loan options, lender evaluations, and suggestions for enhancing credit sco

Online lending platforms have gained recognition as a outcome of their ease of access and fast approval charges. Many of these platforms utilize know-how to streamline the applying process, permitting freelancers to receive funds extra quickly than typical banks. It is crucial, nonetheless, to read the phrases and conditions fastidiously, as some lenders may impose greater interest rates or char

Lastly, building a constructive credit history and managing current debts responsibly can improve the chances of mortgage approval. Freelancers are inspired to regularly monitor their credit score reports and address any discrepancies, further solidifying their place as reliable debt

Canadian pharmaceuticals online shipping

By Kelly Miller

Canadian pharmaceuticals online shipping

By Kelly MillerNghệ Thuật Tưới Nước Cho Mai Vàng: Bí Quyết Dưỡng Cây Để Tạo Nên Vườn Mai Bền Vững

By hennesy Желаете купить по отличной цене аттестат, либо диплом?

By sonnick84

Желаете купить по отличной цене аттестат, либо диплом?

By sonnick84 The Thrill of the Aviator Game: A Sky-High Adventure

By anammdd

The Thrill of the Aviator Game: A Sky-High Adventure

By anammdd Exploring the Vibrant Nightlife of Hong Kong

Exploring the Vibrant Nightlife of Hong Kong